The Healthcare System in Germany

|

| Last Update: November 2021 |

Everything you need to know about the German insurance system

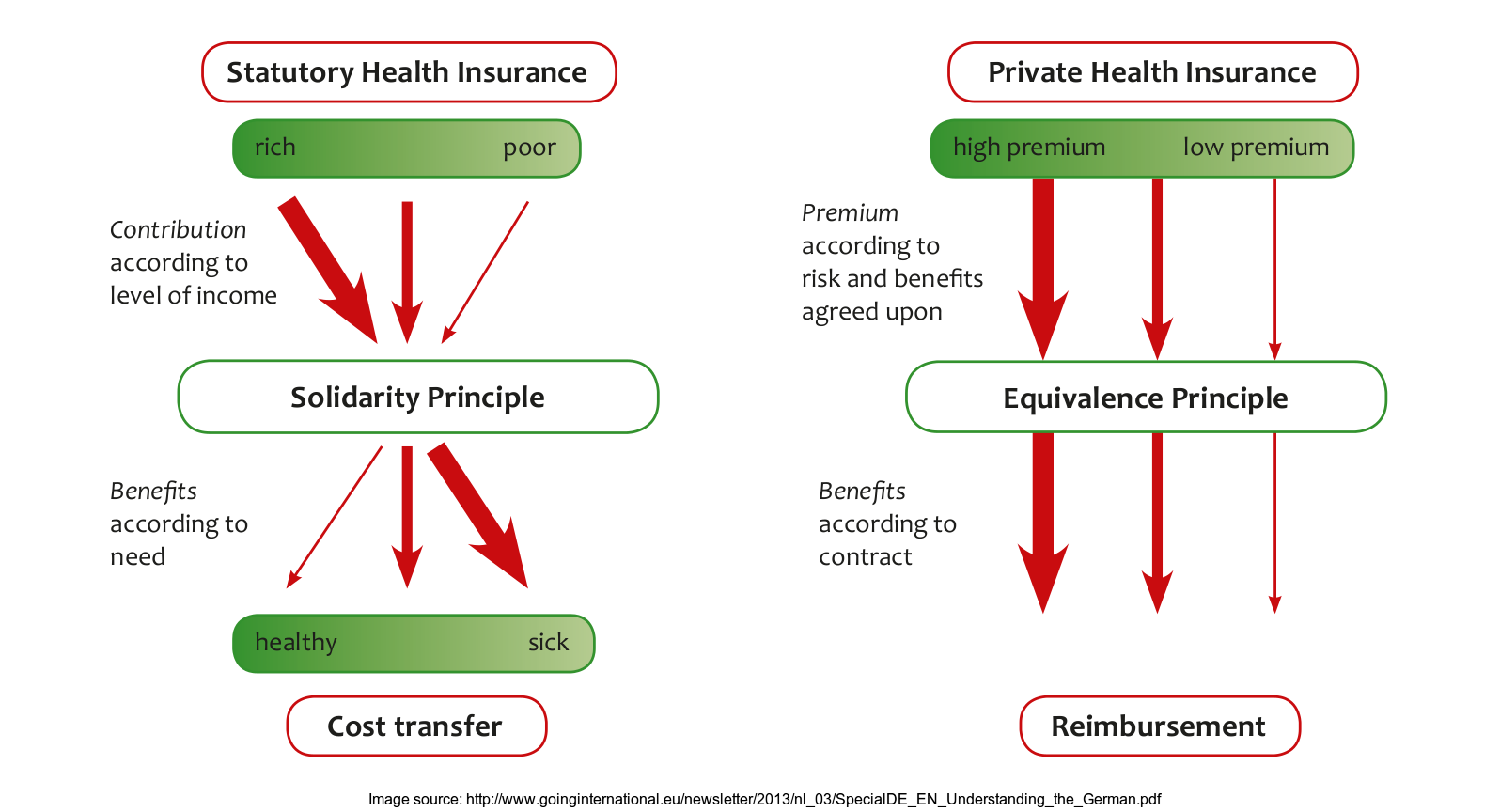

Health insurance is compulsory for the whole population in Germany. Germany has a multi-payer health care system with two main types of health insurance:

'Statutory Health Insurance'

(Gesetzliche Krankenversicherung)

and

'Private Health Insurance'

(Private Krankenversicherung).

'Statutory Health Insurance'

(Gesetzliche Krankenversicherung)

and

'Private Health Insurance'

(Private Krankenversicherung).

There are currently 112 public and 45 private health insurance companies in Germany. This is the reason many people find the whole experience of health insurance shopping overwhelming.

Can I live in Germany without any health insurance?

No, it's illegal to be without insurance! By law, you cannot live in Germany, even temporarily, without being covered by health insurance. If you are not insured, your visa request or university enrollment will be denied.

But what if I have the EHIC?

The European Health Insurance Card (EHIC) is issued by your national health insurance provider and is only valid during a temporary stay in Germany (as well as in any other EU & EEA country). If you're a EU resident, you should apply for your EHIC before traveling to Germany. You need to get information from your insurance provider in your country of origin for all terms & conditions.

If you are in possession of the EHIC, you are entitled to join the public health insurance scheme for free. You just need to forward your valid EHIC to your chosen fund to become a member of it. TK is the most popular public health insurance fund in Germany.

More info about the EHIC here.

Important: If you decide to take gainful employment in Germany, even for a short period, you must apply for German health insurance!

Can I move to Germany with international health insurance?

This could be quite risky because most of the foreign insurance companies are not registered with the financial regulatory authority in Germany, or BaFin. Even international companies that are authorized in Germany often do not meet the requirements & standards decided upon in new reforms. Currently, almost none of the major international health insurers provide a German-language certificate recognized by the visa authorities in Germany, thus your visa or residence permit could be denied.

Update: Some foreigners authorities (Aliens offices) are denying most of the international health insurance plans such as MAWISTA or Care Concept.

Apply for an authorized Expat Health Insurance today to get your visa easily accepted.

[If you can switch to public or private health insurance easily within 2-3 years, if needed].

Do I automatically get insured when I start to work or study in Germany?

No. In Germany, you do not automatically get an insurance card when you start working or studying. You must first register with a 'Krankenkasse' (German health insurance fund). As an employee or a student, you must inform your employer/ university which health insurance company you have chosen.

There are two different types of German health insurance: public health insurance (GKV) and private health insurance (PKV). While most people could be eligible for public health insurance, being accepted by private health insurance is more difficult and tricky (many conditions apply: age limit,...).

If you're applying for a German visa, you'll need to prove to the German authorities that you already have recognized health insurance. In this case, you may need to apply for Expat Health Insurance first, then once you are registered sign up for Public Health Insurance.

There are two different types of German health insurance: public health insurance (GKV) and private health insurance (PKV). While most people could be eligible for public health insurance, being accepted by private health insurance is more difficult and tricky (many conditions apply: age limit,...).

I don't have a German address yet, can I apply for German health insurance?

It depends. If you don't have a German address yet, you'll not be able to become a member of a public health insurance company (e.g. Barmer, TK, AOK). By law, you need first to do the so-called 'Anmeldung' (German address registration). Once your German address is registered at the 'Bürgeramt' (local citizens office), you'll be able to apply for proper German health insurance. More details here.If you're applying for a German visa, you'll need to prove to the German authorities that you already have recognized health insurance. In this case, you may need to apply for Expat Health Insurance first, then once you are registered sign up for Public Health Insurance.

Public health insurance is based on the principle of solidarity to ensure that everybody is able to access health care services.

Which type of health insurance do Germans prefer?

Germans trust their state health system: about 85% of the German population is insured under the GKV (national health system).

Over 9.5 million people are insured with TK, which is one of the biggest statutory health insurance provider in Germany. You can sign up for TK here (it's free and in English!).

Over 9.5 million people are insured with TK, which is one of the biggest statutory health insurance provider in Germany. You can sign up for TK here (it's free and in English!).

Is membership in public health insurance compulsory or voluntary?

Membership in the public insurance is usually mandatory for employees (gross income below the social security ceiling), pensioners (if registered with a statutory health insurance fund or covered by a family insurance plan for a certain length of time) and people receiving social welfare benefits.

It is also possible to be insured on public insurance voluntarily. Usually those eligible are members of public insurance funds who were previously on compulsory public health insurance but do not fall within this category anymore, e.g. employees earning more than 64,350€ per year (gross – 2021 data).

If you earn more than 64,350€ per year, you can choose between public and private health insurance. In this case, the best solution would be to ask for advice from an independent insurance broker who will find the most affordable plan that's right for you in Germany.

What’s the main difference between ‘compulsory’ and ‘voluntary’ public health insurance?

When it’s mandatory to join the public health insurance fund, your employer is required to pay roughly half of the contributions for health insurance and long-term care.

When it’s on a voluntary basis, your employer is also required to pay roughly half of the contributions, but only for those services that match the public health insurance coverage. Ask your employer about details. The difference is mainly the price: once you go ‘voluntary’, you pay more!

The contributions for pension and unemployment insurance are not affected. The employer must always pay these to the health insurance fund.

According to the German civil code (Sozialgesetzbuch), the employer also needs to pay half of the costs of each dependent family member.

Important: When it’s on a voluntary basis, make sure you register with a statutory health insurance within 3 months; after that period, you'll have fewer chances of getting accepted!

Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are not entitled to take out public health insurance! Your best choice is to take out Expat Health Insurance. Once you find a job in Germany, you can easily cancel and switch to public health insurance.

Who is eligible for the compulsory public insurance scheme?

- Employees (if you earn less than 64,350€ per year – 2021 data)

- Students under the age of 30 (or until the 14th semester is reached)

- Pensioners (if registered with a statutory health insurance fund or covered by a family insurance plan for a certain length of time)

- Recipients of social welfare benefits

- Freelancers (only if you had prior public health insurance cover in Europe & apply within 3 months of arriving in Germany – there are also other conditions)

- Self-employed/freelancing artists or journalists registered with the KSK (also for unemployed people having the 'artist' status)

You can sign up for TK here (it's free and in English!).

What are the advantages of choosing public health insurance instead of a private one?

- Fees do not depend on your age or your health status;

- Your medical history doesn't matter;

- All public health insurance companies offer more or less the same basic benefits and there is no difference between those benefits;

- You can insure your children and spouse for free through the family insurance plan (if they have no income or only low income of their own);

- Students with low or no income benefit from a fixed reduced rate.

Contributions are based on your income and are deducted every month from your gross salary. Your employer roughly pays half of the amount that is decided by law.

On top of this comes an additional premium that may vary depending on the health insurance fund. In 2020, public health insurance payments are set at 14,6% + roughly 1% supplementary charge (depends on the provider), and 3,05% (3,3% if over 23 with no children) extra for providing long-term nursing coverage.

You will often benefit from a reduced contribution if your salary is between 450,01€ and 850€.

On top of this comes an additional premium that may vary depending on the health insurance fund. In 2020, public health insurance payments are set at 14,6% + roughly 1% supplementary charge (depends on the provider), and 3,05% (3,3% if over 23 with no children) extra for providing long-term nursing coverage.

You will often benefit from a reduced contribution if your salary is between 450,01€ and 850€.

If you earn less than 64,350€ per year, you are entitled to sign up for TK here.

Freelancers or self-employed people are not always entitled to join the public health insurance scheme.

As a freelancer, you may probably need to apply for private health insurance (not that easy if you're new in Germany!). Read our “German Private Health Insurance” section further down for more details.

As a freelancer, you may probably need to apply for private health insurance (not that easy if you're new in Germany!). Read our “German Private Health Insurance” section further down for more details.

Important: You may qualify for public health insurance if you have had prior public health cover in Germany or in the rest of Europe and apply within 3 months of arriving in Germany.

Special case: There is a social security insurance scheme (KSK) for self-employed/freelance artists and writers (journalists, editors, writers, and so on). However, it's almost impossible to sign up for public health insurance through the KSK scheme if you have been previously insured by private health insurance for a few years.

Special case: There is a social security insurance scheme (KSK) for self-employed/freelance artists and writers (journalists, editors, writers, and so on). However, it's almost impossible to sign up for public health insurance through the KSK scheme if you have been previously insured by private health insurance for a few years.

By law, all students enrolled at German state universities, state colleges and universities of applied sciences as well as those who are completing practical training (as stipulated in the study regulations for a degree course) are subject to compulsory public health insurance. Without proof of health insurance, enrollment is not possible.

As a foreign student in Germany, you must insure yourself with statutory health insurance if you are under the age of 30 (until you reach your 30th birthday or until your 14th term of study). After that, you can still choose public health insurance but on a voluntary basis.

Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are not only entitled to take out public health insurance! Your best choice is to take out Expat Health Insurance. Once you find employment in Germany, you can easily cancel and switch to public health insurance within 2-3 years.

Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are not only entitled to take out public health insurance! Your best choice is to take out Expat Health Insurance. Once you find employment in Germany, you can easily cancel and switch to public health insurance within 2-3 years.

Important: Foreign students who are privately insured (for whatever reason) but have not yet reached the age of 30 will require a waiver from the public health insurance. Afterwards, taking out insurance with a statutory health insurance fund will no longer be possible!

As an international student, can I be exempt from taking out German health insurance?

It depends. If you come from EU/EEA countries, are under the age of 30 (until you reach your 30th birthday or until the 14th semester) and are in possession of the EHIC, you can be exempt from taking out health insurance in Germany, but you'll need to provide proof of health insurance from your country of origin. You need to get information from your insurance provider in your country of origin for all terms & conditions.

Important: Please use your EHIC to register with a statutory health insurance fund in Germany (i.e. TK). The insurance fund will then provide a confirmation for enrollment at the university.

Important: Please use your EHIC to register with a statutory health insurance fund in Germany (i.e. TK). The insurance fund will then provide a confirmation for enrollment at the university.

More info about the EHIC here.

Info about other social security agreements outside the EU here.

Is compulsory public health insurance convenient for a student?

Yes, it's often cheaper than private health insurance. The public health insurance is offered at an average reduced rate of 110€ per month (incl. long-term nursing cover). Rates can differ slightly if you're married or have children. The contributions are fixed by law, so all national health insurance providers have the same monthly rates.

I'm 31 years old, can I choose public health insurance on a voluntary basis?

Yes, but... PhD students or students after the 30th birthday (or after the 14th semester) will have to pay an extra individual rate or, sometimes, may not be eligible at all to join public health insurance.

Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are NOT entitled to take out public health insurance. Your best option here is to take out Expat Health Insurance.

Private health insurance is chosen by those who do not fall into the compulsory public insurance category, e.g. self-employed or freelancers, employees above a certain salary, and so on.

Private health insurance is more complex because fees are based on your state of health, your age and on your insurance tariff, thus fees can change from one person to another.

If you have a low income and plan to stay in Germany for less than 3 years, no private health insurance provider on the market would accept you as they require a term of a minimum of 3 years.

For a better understanding of the private health insurance system, we would divide this section in

4 main categories:

Pro: Services could be individually adapted to your needs (i.e. there are treatments & drugs that are not available on the public insurance, but are covered by private insurances).

Private health insurance fees can vary from one person to another. This can be surprisingly difficult to grasp if you're a freelancer and relatively new in Germany. Taking on a new client is a lifelong commitment for the insurance company – which is not allowed to throw out clients because of high claims or non-payment of their monthly premiums. So insurers are likely to require confirmation of your income. Many companies often require a minimum period of two years visa to be suitable for private insurance. It gets easier when you have a German credit history of two or three years; so your situation could be easier if you decide to stay in Germany for a long term.

The best thing to do is to already search for a solution before entering Germany! We recommend you sign up for Expat Health Insurance. Once you have a steady income, you can easily cancel and switch to Public or Private Health Insurance.

If you are employed in Germany and earn more than 64,350€ per year (gross - data 2021), you can choose to leave public health insurance and get private health insurance. Your employer will contribute roughly half of its cost.

If you are young, healthy and earn a high salary, private health insurance may be cheaper than the public option.

Reminder: Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are only entitled to take out private health insurance!

German Expat Health Insurances are also private insurances, but they are specifically designed for non-EU foreigners coming to Germany (incl. Schengen area) on a time-limited stay from 1 up to 5 years or for foreigners not being entitled to any other German health insurance, e.g. freelancers without steady income who just moved to Germany from a non-EU country.

For a better understanding of the private health insurance system, we would divide this section in

4 main categories:

* German Private Health Insurance

* German Private Health Insurance for Time-limited Stays (or Expat Health Insurance)

* International Private Health Insurance (not always valid in Germany)

* Other German Private Insurances

What is the main pro and con of private health insurance?

Pro: Services could be individually adapted to your needs (i.e. there are treatments & drugs that are not available on the public insurance, but are covered by private insurances).

Con: You'll first have to pay some treatment costs yourself and the insurance company will then reimburse your costs at a later stage upon submission of the bill. This is often not the case for small bills which could be paid out of pocket. Concerning big expenses (i.e. operations), you should always ask for clearance from your insurer beforehand.

Private health insurance contributions are based on your risk profile (i.e. your state of health, your age). The older you are, the less attractive you are for private insurance.

[Important] Private health insurance co-payments (Selbstbeteiligung):

If you get injured because of an accident or have a serious illness, treatments could be expensive and not be covered by your insurance plan. This is when co-payments, also known as deductibles or excess (Selbstbeteiligung) come in.

Private health insurance works this way:

Every month you pay a premium (Beitrag) and choose a level of deductible.

Example: a deductible of 200€ means that you pay 200€ before your insurance policy kicks in. It’s a compromise! You can either choose a private plan with less co-payment but a higher monthly premium, or a private plan with more co-payment but a lower monthly premium.

Tip: Advice from an independent certified insurance broker is recommended for this category. If you want to check what is available for your situation on the whole German market, you can request a free and non-binding quote here.

Who would be eligible for private health insurance?

- Employees (if you earn more than 64,350€ per year - 2021 data)

- Civil service workers

- Self-employed and freelancers

- Students above the age of 30 (if you are under the age of 30, you'll need to get a waiver from the public health insurance)

If you are unemployed (but not registered at the Agentur für Arbeit), self-employed or currently looking for a job and you've just moved to Germany from a non-EU country, then you should sign up for Expat Health Insurance (limited to 5 years). Once you have a steady income, you can easily cancel and switch to Public or Private Health Insurance.

Private health insurance fees can vary from one person to another. This can be surprisingly difficult to grasp if you're a freelancer and relatively new in Germany. Taking on a new client is a lifelong commitment for the insurance company – which is not allowed to throw out clients because of high claims or non-payment of their monthly premiums. So insurers are likely to require confirmation of your income. Many companies often require a minimum period of two years visa to be suitable for private insurance. It gets easier when you have a German credit history of two or three years; so your situation could be easier if you decide to stay in Germany for a long term.

The best thing to do is to already search for a solution before entering Germany! We recommend you sign up for Expat Health Insurance. Once you have a steady income, you can easily cancel and switch to Public or Private Health Insurance.

If you are employed in Germany and earn more than 64,350€ per year (gross - data 2021), you can choose to leave public health insurance and get private health insurance. Your employer will contribute roughly half of its cost.

If you are young, healthy and earn a high salary, private health insurance may be cheaper than the public option.

Important:

Should you switch to private it is very hard to go back to public. In certain situations, it is even impossible! Once you are privately insured, you cannot take out public insurance unless your income drops below €64,350 (Gross salary per year) or you become unemployed. And if you are over 55, it is almost never possible.

Should you switch to private it is very hard to go back to public. In certain situations, it is even impossible! Once you are privately insured, you cannot take out public insurance unless your income drops below €64,350 (Gross salary per year) or you become unemployed. And if you are over 55, it is almost never possible.

Private health insurance is usually only allowed in exceptional cases (e.g. above the age of 30).

Reminder: Pupils, language students, students enrolled in preparatory (language) courses for university, trainees (not for university purposes), scholarship holders & doctoral candidates are only entitled to take out private health insurance!

In this case, your only solution is to sign up for Expat Health Insurance for the time being. This insurance is the perfect solution for getting your visa or residence permit easily accepted. However, it's not a good solution for renewing a residence permit!

Important: This Expat insurance is meant as a temporary solution with the aim of you switching to proper private or public health insurance afterwards.

Important: Non-EU foreign students participating in language courses in Germany as well as grant holders cannot join the public health insurance scheme. In these cases, you'll need to take out expat health insurance.

Sign up for Expat Health Insurance today.

Note: If you are in possession of the European Health Insurance Card (EHIC) or any other Insurance Card accepted in Germany (see here), you can be exempt from taking out health insurance in Germany, but you'll need to provide proof of health insurance from your country of origin. You need to get information from your insurance provider in your country of origin for all terms & conditions.

This kind of insurances could be very risky as they often do not meet German standards (i.e. MAWISTA & CARE CONCEPT).

Some of these non-German insurance companies have been recognized by the German financial regulator (BaFin) as meeting the requirements for residents in Germany, but they usually do not provide documents in German, which would be necessary for passing the 'visa authorities test'. Moreover, this recognition is currently being challenged by German private health insurance companies so it might not be an acceptable solution for much longer. Finally, the visa office also imposes additional requirements.

Update: The Ausländerbehörde (LABO) in Berlin is denying some of the international health insurance plans (e.g. MAWISTA or CARE CONCEPT). Make sure to ask your insurance broker about this situation!

Supplemental insurances are useful to complement the health insurance system which is not complete. You can apply for it on top of your public health insurance no matter your income, e.g. dental, vision, travel or alternative practitioner insurances.

If you are privately insured, you cannot take out supplemental insurance! You'll need to talk to your private insurer and extend your existing tariff to include additional services.

---------------------

We, at myGermanExpert, can recommend you Feather and BProtected. We trust them.

Important: This Expat insurance is meant as a temporary solution with the aim of you switching to proper private or public health insurance afterwards.

Who can take out a German expat health insurance?

- Non-EU citizens not entitled to take out public health insurance;

- Non-EU citizens being refused by a traditional German private health insurance (i.e. those not having a German credit history of two or three years, those not having a minimum of 2 years visa, and so on);

- Non-EU citizens who need proof of health insurance to obtain a visa (i.e. 'Artist' visa,...);

- Schengen visa holders (here is the Schengen visa application form);

- Students from outside the EU above the age of 30 (and under the age of 35);

- Au Pairs or other people in work placements from outside the EU (under the age of 35);

- Pupils, language students, trainees, scholarship holders & doctoral candidates from outside the EU (under the age of 35);

- Non-EU students enrolled in preparatory (language) courses for a university (You will not receive insurance from a state insurance company in Germany. You must take out private insurance);

- Visiting academic (researchers) from outside the EU with no employment contract (A visa will only be granted if proof of appropriate health insurance is provided);

- Non-EU visiting academics with a bursary (Only private health insurance is possible!);

- Participants in Work & Travel Programs;

- Foreign visitors & guests from outside of the EU;

- Holidaymakers in Germany coming from a non-EU country;

- Foreign citizens from a non-EU country with no income (Remember: it's illegal to stay in Germany without any health insurance).

Important: Non-EU foreign students participating in language courses in Germany as well as grant holders cannot join the public health insurance scheme. In these cases, you'll need to take out expat health insurance.

Sign up for Expat Health Insurance today.

Note: If you are in possession of the European Health Insurance Card (EHIC) or any other Insurance Card accepted in Germany (see here), you can be exempt from taking out health insurance in Germany, but you'll need to provide proof of health insurance from your country of origin. You need to get information from your insurance provider in your country of origin for all terms & conditions.

Can I use this expat health insurance for my visa application?

Yes! This expat health insurance meets all requirements for visa and residence permit applications. For example, it is accepted for your: freelance visa, job seeker visa, Blue Card, etc.Can I renew my residence permit with that insurance?

No! Expat insurances are a good option for your short-term stay in the country, but not for renewing a residence permit at the aliens' office (Ausländerbehörde) in Germany as they are not compliant with §257 SGB V, §61(6) SGB XI.No matter whether you are staying abroad for a long term or only for a short break - do not forget that health insurance is compulsory for the whole population in Germany.

This kind of insurances could be very risky as they often do not meet German standards (i.e. MAWISTA & CARE CONCEPT).

Some of these non-German insurance companies have been recognized by the German financial regulator (BaFin) as meeting the requirements for residents in Germany, but they usually do not provide documents in German, which would be necessary for passing the 'visa authorities test'. Moreover, this recognition is currently being challenged by German private health insurance companies so it might not be an acceptable solution for much longer. Finally, the visa office also imposes additional requirements.

Supplemental insurances are useful to complement the health insurance system which is not complete. You can apply for it on top of your public health insurance no matter your income, e.g. dental, vision, travel or alternative practitioner insurances.

If you are privately insured, you cannot take out supplemental insurance! You'll need to talk to your private insurer and extend your existing tariff to include additional services.

Any type of insurance policy that protects you as an individual from the risk that you may be held legally liable for something such as malpractice, injury or negligence.

Liability insurance policies (Haftpflichtversicherung) cover both legal costs and any legal payouts for which you would be responsible if found legally liable. Over 80% of German adults have liability insurance.

Here are the 4 major risks you better be covered with:

- Personal injury: you accidentally bump into someone and, as a result, that person requires medical treatments;

- Property damage: you accidentally break an item belonging to someone else while visiting that person's property;

- Monetary penalty: you accidentally injure someone and, as a result, that person cannot go to work for some time & loses income;

- Third-party claim: someone sues you but you didn't do anything wrong!

It is a home contents insurance policy that combines various personal insurance protections, which can include losses occurring in your home, its contents or loss of other personal possessions in your home.

This legal insurance will cover the costs for disputes with your neighbour or your landlord (i.e. paying a lawyer to protect you).

The information provided in this article is not intended to provide or be a substitute for specific individualized insurance advice. Where specific advice is necessary or appropriate, myGermanExpert recommends consultation with an insurance adviser.

Need help?

Health insurance brokers can help you find the best health insurance for your situation and budget. Only certified insurance brokers can provide health insurance recommendations or advice.

We, at myGermanExpert, can recommend you Feather and BProtected. We trust them.

Which provider should I choose?

- If you just need health insurance for your visa or residence permit application, choose the Expat Health Insurance from Feather. It is a sure thing! It is approved by the authorities. Affordable and 100% in English!

- If you need Public Health Insurance, you can sign up for TK here via Feather. It's free and 100% in English. It is mainly available for employees earning less than 64,350€ a year and university students.

- If you want Private Health Insurance, you can request a free consultation with BProtected here.

- Other insurances, if needed: private liability insurance, household/home contents insurance and dog insurance. They are affordable, in English and 100% digital.

0 Comments